3M will start paying out its $12.5 billion "forever chemicals" settlement with public water systems later this year after a federal judge gave final approval to the deal last week.

The settlement, announced last summer, will pay drinking water providers around the country for PFAS remediation over the next 12 years.

3M pioneered the use of per- and polyfluoroalkyl substances 70 years ago, but is now reckoning with their environmental and health costs.

CEO Mike Roman, using an oft-repeated phrase when announcing the court's approval on Monday, said the settlement will "reduce risk and uncertainty."

"This is yet another important step forward for 3M as we continue to deliver on our priorities," Roman said in a statement.

3M is also discontinuing its PFAS production and sales by the end of 2025. The water systems settlement does not end all pending PFAS litigation against the company, and analysts have floated billions more in potential payouts in the coming years.

Payments are expected to begin this fall and will continue through 2036. The bulk of the payments will be made by 2028, according to 3M.

3M's stock price rose 6%, when adjusting for the impact of the health care spinoff, to close at $94.02 on Monday. The Maplewood-based company has recast its historical stock prices to reflect a company without a health care division in order to make reasonable comparisons going forward.

On a non-adjusted basis, the company's stock price closed considerably higher to end last week at $106.07. 3M shareholders as of March 18 received one share of Solventum for every four shares of 3M they owned.

Jonathan Sakraida, equity analyst at CFRA Research, said shares are "settling lower" but that 3M "will be better positioned for recovery with a new CEO, a more focused operating model and reduced litigation overhang," he wrote Monday. "However, we view risks as still being elevated in the near term."

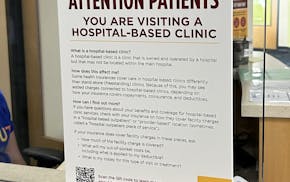

Minnesota lawmakers propose ban on facility fees that trouble patients, increase spending

Luigi Mangione pleads not guilty to federal death penalty charge in UnitedHealthcare CEO's killing

That $7 latte at Twin Cities coffee shops may soon cost more