A $71 million fraud case in South Dakota is the latest blow to the organic supply chain.

Federal prosecutors in February accused Kent Duane Anderson, a Rapid City, S.D., businessman, with passing off conventional grain and seed as organic for more than five years.

Anderson pleaded not guilty to charges of wire fraud and money laundering.

The case is the second large-scale organic fraud case in the Midwest to attract federal prosecution in less than a year, and comes amid ongoing concern over fraudulent organic imports.

The South Dakota case is frustrating but unfortunately not a surprise, said Erin Heitkamp, a vice president at Pipeline Foods, a Minneapolis-based organic supply-chain company. Her firm has reported concerns, often about middlemen such as Anderson buying and selling grain from a desk, to certifiers and government regulators.

"There will likely be more investigations and prosecutions," Heitkamp said. "I expect to see more and more shoes drop over time."

Prosecutors said Anderson bought nonorganic grain and seed from Cargill and Archer Daniels Midland, shipped it to a storage facility just east of Bismarck, N.D., labeled it as organic, and sold it to organic customers.

He turned a profit of about $25 million on the fake organic sales between 2012 and 2017. The website for one of Anderson's companies, Green Leaf Resources, said it offers "both natural and certified organic flax and canola" seeds, meal and oils.

Growing truly organic grain is arduous. Most synthetic pesticides and herbicides are forbidden, so farmers must alter the ways they fight weeds and bugs and they must rotate crops more often. For those reasons, organic grain and seed sell for significantly higher prices than conventional grain and seed.

In the organic industry, which bases its premium prices on customer trust, the drumbeat of fraud is troubling.

"$71 million is not an insignificant amount of money, and it really taints the market," said Ryan Koory, director of economics for Mercaris, an organic market data and trading company. "What matters to organics is integrity, and your ability to believe in the product."

The charges against Anderson echo the case against Randy Constant, a Missouri businessman who in August was sentenced to 10 years in prison for selling $140 million in fake organic corn and soybeans through a company in northeast Iowa. Constant took his own life at his home in Missouri the day of the sentencing, and a handful of his business partners also faced criminal charges.

As with the Constant case, the charges against Anderson allege extravagant personal spending from the proceeds of the fraud. Anderson bought a custom 86-foot yacht from Italy for $8 million, a $2.4 million dollar home in Florida, multiple Range Rovers and $400,000 in jewelry, much of it purchased at a shop in the U.S. Virgin Islands.

The means by which Anderson obtained organic certification for the grain he sold is not clear.

Of the several business entities listed in the indictment, only one, Green Leaf Trading LLC, shows up in the USDA's Organic Integrity Database. The firm is listed with a Spokane, Wash., address, but the contact is Michele Heckel, vice president of operations for Green Leaf Resources. Green Leaf Trading was certified organic through the Global Organic Alliance, an Ohio certifier, and its certification was revoked in 2015.

A representative from the Global Organic Alliance could not be reached for comment.

The buyers of Anderson's fake organic grain are not identified in the charging documents.

Organic fraud can escape notice because regulatory oversight hasn't kept up with the growth of the industry, said Heitkamp. U.S. organic sales were $48 billion in 2018.

Ideas and suggestions for articles for the agriculture page are welcome at adam.belz@startribune.com .

That $7 latte at Twin Cities coffee shops may soon cost more

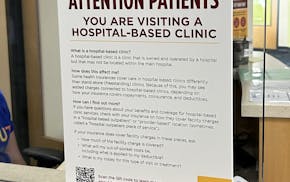

Minnesota lawmakers propose ban on facility fees that trouble patients, and drive $1B in spending

St. Paul duplex with bungalow vibe on the market for just under $700K