Once her doctor recommended sinus surgery, and insurance confirmed prior authorization wasn't needed, Christine Knirk focused on getting the procedure and getting better.

The outpatient operation happened just over a year ago and has brought the medical relief Knirk sought.

But getting the procedure paid for by insurance has created months of aggravation for the 65-year-old Burnsville resident.

Knirk's story is a window into the continuing — and perhaps growing — tension between health insurers and health care providers over coverage denials. Denials without a clear reason can be maddening for patients who are often left feeling helpless. It also highlights the lack of comprehensive public data on how often and why denials happen.

"We've always been frustrated with the lack of transparency ... trying to figure out what are the types of services that are being denied and what are the reasons," said Kaye Pestaina, a vice president at the California-based health policy group KFF.

In August, Horizon Blue Cross Blue Shield of New Jersey — the insurer for Knirk's employer-sponsored health plan — told her after the procedure was done that it would not cover most surgery costs. The insurer had determined the procedure was not medically necessary.

Knirk began the appeal process the next month, but hit a low point in late March when she received a letter from her health care provider, Park Nicollet, relaying that she was responsible for more than $30,000.

Working on the appeal was confusing and plagued by miscommunication, Knirk said. She spent decades working in customer service, addressing concerns over the phone for a manufacturer, until her recent retirement. Her experience trying to get clear support from the health care companies was jarring.

"I come from the school of customer service where you take the call, you take the issue and you follow it through resolution," Knirk said. "Nobody seems to want to do that. ... I'm stuck in the middle."

In early April, the Star Tribune contacted both Horizon Blue Cross Blue Shield and Park Nicollet with questions about the billing dispute. Just over a week later, the insurer said it was paying the bill with no additional financial responsibility for Knirk.

The problem, according to Horizon Blue Cross, was that Park Nicollet initially sought prior authorization for the wrong procedure. That requested surgery didn't need advance approval. However, it was required for the treatment Knirk actually received in March 2023. This was a "misstep by Park Nicollet," the insurer said, that delayed the usual process to confirm coverage ahead of time.

"Delays in obtaining additional medical records necessary for this after-the-fact review resulted in the subsequent appeal remaining open until those records were located and reviewed," the insurer said in a statement to the Star Tribune. "The claim has been approved and was processed for payment."

Bloomington-based HealthPartners, which runs Park Nicollet, disputed this explanation, saying: "We were never denied for a coding or authorization error." The real problem, HealthPartners said, was a significant delay in the appeals process due to what it called a "clerical error" at Blue Cross.

"We remained in contact with BCBS and Christine until BCBS found the misfiled appeal in December," the health system said in a statement to the Star Tribune. "We shared timely clinical information with BCBS to support the medical need for her procedure."

The data on denials

For decades, there have been disputes between health insurers and health care providers over claims denied due to findings on the medical necessity.

Yet experts say there's still a lack of comprehensive public data on the frequency of medical necessity denials vs. other reasons, particularly when it comes to employer-sponsored coverage.

This week, the consulting firm Kodiak Solutions presented data to the American Hospital Association showing initial denials from health insurers have increased significantly in recent years, growing from 1.2% in 2020 to 1.7% in 2023. The report noted increases across several different types of insurance, particularly for inpatient care.

AHIP, the national trade group for insurers, didn't comment on these numbers, but said such figures can be misleading when studies don't specify how many claims were studied or provide context on why denials occurred.

Insurers can deny claims when health care providers don't provide supporting clinical documentation to justify payment in a timely manner, said Robert Traynham, executive vice president of public affairs at AHIP. Payment might be denied to address fraud, waste and abuse, such as when there are duplicate requests, he said.

And some denials are paired with approvals of alternate therapies that better fit clinical guidelines. That can happen, for example, if a health insurer approves a four-day hospital stay when seven days were requested.

"Denials may be triggered because requested services are inconsistent with the latest clinical guidelines and evidence-based medicine, thereby putting patient-safety and good clinical outcomes at risk," Traynham said in a statement.

Health care providers, however, say it's clear that they're running into more trouble with health insurance denials, including those stemming from technicalities or paperwork issues that should be much easier to resolve.

With medical-necessity denials, insurers sometimes refer to internal guidelines that vary from national standards set by professional groups, argued Terrence Cunningham, director for administrative simplification policy at the American Hospital Association. Another problem, Cunningham said, is that insurer policies vary from one another and are frequently updated, making it hard to comply with all the rules.

"There's been a lot of talk over the last couple of years about surprise bills and what happens when people go out-of-network," said Molly Smith, the group vice president for public policy at the American Hospital Association. "Probably the bigger surprises are when people have insurance, and they're going in-network ... and then their coverage fails them. We really think this is an area for increased oversight."

In a statement, AHIP countered that hospitals seem to think "it's perfectly fine to charge and demand extreme prices for medical services without any consideration about the impact of those prices on consumers' premiums or their cost-sharing."

'So gummed up'

Park Nicollet was an in-network provider for Knirk's health plan. The insurance limited out-of-pocket spending for covered expenses to less than $4,000, so Knirk was shocked when Park Nicollet's letter in March said she was responsible for $32,449.52.

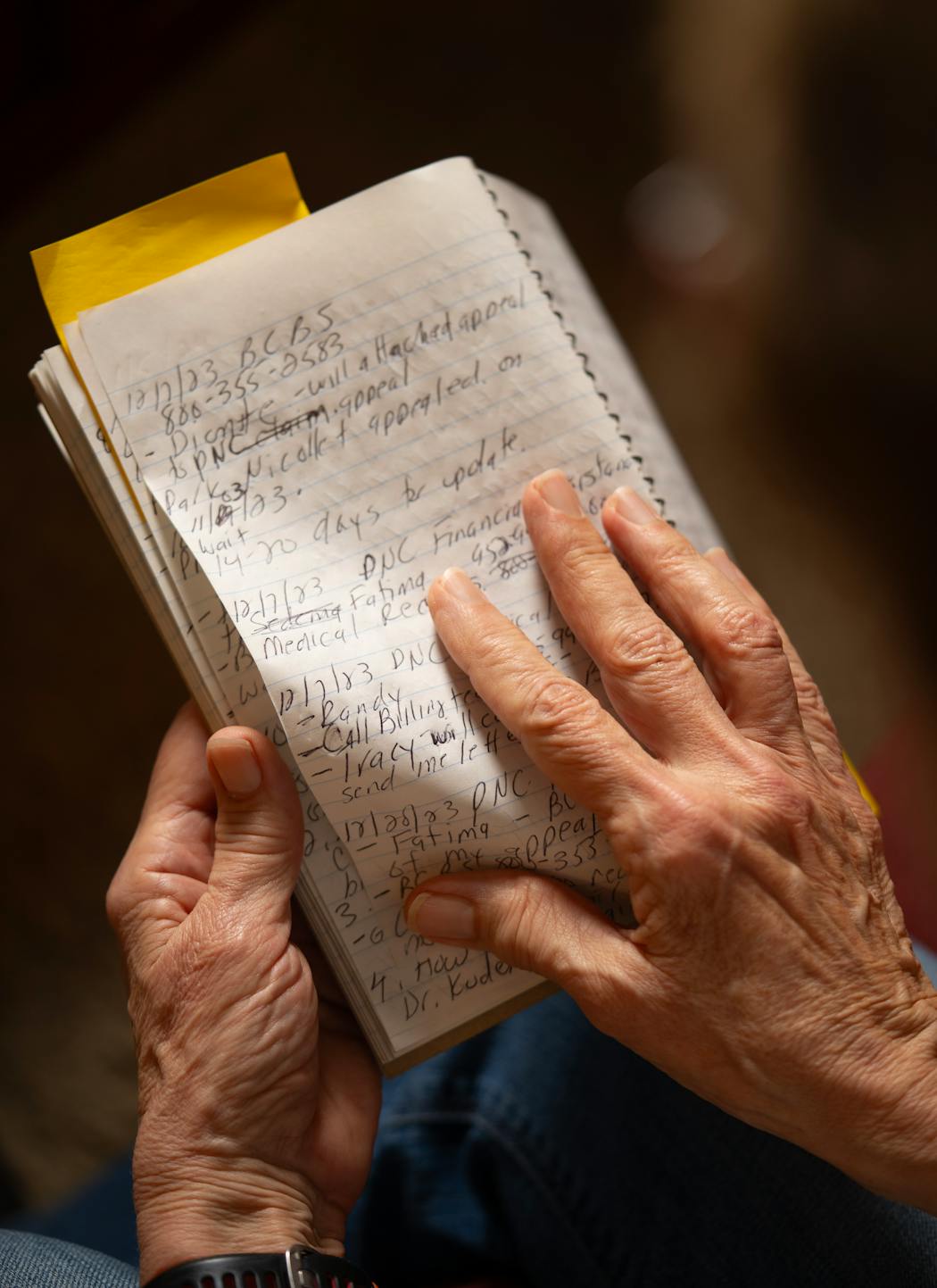

Knirk said the letter was also frustrating because it said she hadn't asked Park Nicollet to file an appeal on her behalf. A notebook — with records of the 32 phone calls she completed over seven months trying to get the matter resolved — says otherwise.

Park Nicollet told her in September she would have to lead the appeal, Knirk said, and then later filed its own appeal — duplicating work to assemble medical records she would have been happy to avoid.

HealthPartners says there was an "unfortunate" misunderstanding on the appeal process, and added in a statement: "We're committed to partnering with our patients to help them navigate insurance coverage."

Knirk said she also received confusing messages from Horizon Blue Cross Blue Shield on what constituted a "first-level" and "second-level" appeal in her case. In February, when she spoke with the insurer for a status update, Knirk was dismayed to hear from a customer service representative that the appeal had been sitting in a queue, not yet activated.

Without responding to all of Knirk's specific concerns, the insurer said in a statement: "This is an important reminder that patients deserve and need providers and health insurers to work together fulfilling our individual and collective responsibilities to make health care work the way we all want."

Knirk is happy to now to be out from under the threat of a huge medical bill. But she's sharing her story to warn consumers about how things can go wrong — and implores others to push insurers and health care providers to do better.

"I still think: 'Why weren't Blue Cross Blue Shield and Park Nicollet more in communication on this?'" she said. "This whole appeals system is so complicated. I don't know why things have gotten so gummed up."

Minnesota Department of Health rescinds health worker layoffs

Eco-friendly house on 30 acres near Marine on St. Croix listed at $1.6M

DOGE cuts federal money for upgrades at Velveeta plant in New Ulm