Minnesota transportation and logistics company C.H. Robinson says it has identified almost $1 billion in potential refunds of tariffs its American clients paid on Chinese imports.

The Eden Prairie-based Fortune 500 corporation warns that other U.S. companies could lose out on hundreds of millions of dollars of potential refunds by year's end. That is when a refund program administered by the U.S. Trade Representative (USTR) is scheduled to run out.

"We do believe plenty of opportunity is being missed," said Mike Short, C.H. Robinson's president of global forwarding.

President Donald Trump placed tariffs on four lists of Chinese goods beginning in 2018. Cumulatively, roughly two-thirds of Chinese exports to the U.S. are now taxed. The president sought to punish the Chinese for unfair trade practices such as forcing U.S. companies to share technology secrets in order to do business in China, theft of American intellectual property and government-subsidized dumping of products in U.S. markets that undercut sales of similar American-made products.

The tariffs set off a trade war between the world's two largest economies with China applying retaliatory tariffs to U.S. products sold to China, notably soybeans.

Trump claims that China pays the U.S. tariffs. In reality, U.S. companies do. Tariffs paid by U.S. businesses rocketed from $33 billion in 2017 to $71 billion in 2019, according to a study by Daniel Ikenson of the Cato Institute, a libertarian think tank.

This is why Wheel Pros sought Robinson's help.

The California company already paid a 2.5% tariff on its Chinese imports before the trade war, said Holly Smith, Wheel Pros logistics director. Trump administration tariffs added an additional 22.5% to Wheel Pros' product costs. Without relief, the company might have been forced to pass some of its increased costs on to its customers, Smith said.

"C.H. Robinson just guided us through the process," Smith said. "They were really good at giving us information as things unfolded. It's a very complicated process."

Smith declined to say how big a refund Wheel Pros is seeking from the government, saying only it was a "significant amount."

C.H. Robinson is one of several customs brokers, trade associations and law firms that offer to guide clients through the shoals of an arcane regulatory process that includes thousands of product categories on harmonized tariff schedules (HTS) where the U.S. government has added exclusions based on the inability of U.S. companies to find American-made replacements. The exclusions aim to "protect U.S. entities if they can't source [materials] in the U.S.," Short said.

Businesses such as C.H. Robinson with expertise in transportation and logistics can mine tariff lists for excluded products categories and match an individual company's specific imports to those categories. However, the USTR must eventually approve requests for relief.

An October Congressional Research Service (CRS) report showed just how difficult that can be.

USTR granted 35% of refund requests for the first two lists of taxed Chinese products, CRS said. The approval rate dropped to 5% on the third list and 7% on the fourth. In total the trade representative has approved just 13% of nearly 53,000 requests for tariff relief.

USTR did not respond to a request seeking data on the exclusion program.

CRS said it cannot determine the dollar amount of tariff relief the government has granted. But the research service said the COVID-19 pandemic has caused USTR to largely focus on medical supplies in granting refunds. Still, USTR makes decisions on a case-by-case basis.

"The agency," CRS reported, "has indicated that, in determining which requests to grant, it considers the following: (1) availability of the product in question from non-Chinese sources; (2) attempts by the importer to source the product from the United States or third countries; (3) the extent to which the imposition of Section 301 tariffs on the particular product will cause severe economic harm to the importer or other U.S. interests; and, (4) the strategic importance of the product to "Made in China 2025" or other Chinese industrial programs."

"Past exclusions," the CRS report continued, "also have been granted for reasons that are thought to include, among others, U.S. national security interests and demonstrable economic hardship from the tariffs for small businesses."

Jim Spencer • 202-662-7432

That $7 latte at Twin Cities coffee shops may soon cost more

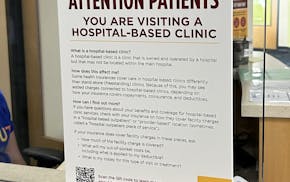

Minnesota lawmakers propose ban on facility fees that annoy patients, and drive $1B in spending

St. Paul duplex with bungalow vibe on the market for just under $700K