Recent content from Chris Farrell

Despite expense, long-term financial return on bachelor's degree still beats other options

In the short term, a two-year degree can pay off more quickly.

Warren Buffett's retirement marks end of an investing advice era

Investing in Berkshire Hathaway starting in the mid-1960s would have netted you more than a billion dollars by now.

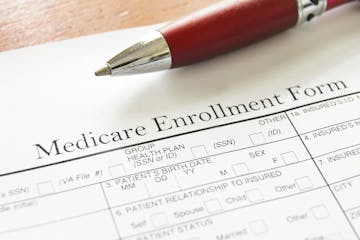

Department of Government Efficiency causing confusion about when to claim Social Security

Common advice is to delay as long as possible once you reach claiming age of 62 to 70.

Risk, return and time: Key variables in the money-managing equation

One of the most important realizations in personal finance, beyond what's to gain and lose, is understanding that time is a critical and scarce resource.

Don't shred tax materials yet — there's still valuable financial insight to gain

While the filing deadline has passed, the information you gathered can help you make better money decisions than last year.

Trump tariffs whipped up a deluge of financial advice. Here's how to interpret it.

From current CEO Vitaliy Katsenelson to financier J.P. Morgan and economist Paul Samuelson, the best money-management advice has always been staying true to who you are.

Chris Farrell: Living frugally in the long term helps weather short-term economic downturns

You can't control President Donald Trump, the stock markets or the economy. But you can take practical steps to navigate the turmoil, including reviewing your household budget.

As tuition costs and student debt rise, many question if college is worth it

Data proves postsecondary education, whether that's an associate or bachelor's degree, does increase a student's earning potential.

Unfounded attacks on Social Security Administration could impact retirees

Elon Musk and his Department of Government Efficency have targeted the most successful social policy program in modern U.S. history.

Many workers also become caregivers, so plan for it financially

In a recent survey, the majority of employees who are or have been caregivers have made at least one work-related adjustment, like missing days of work or reducing hours.

Taxable, tax-deferred, tax-free: How to diversify your retirement portfolio

Smart retirement planning involves taking advantage of the differing tax treatments on accumulated savings.

U.S. Treasuries remain safe bet for your money despite economic, political uncertainty

Trust in the creditworthiness of U.S. Treasuries has eroded somewhat.

A financial plan to guide late-life decisions will help weather unpredictable future

Retirement or semi-retirement is a complicated transition involving many financial and lifestyle decisions, and it pays to create a comprehensive plan.

When it comes to AI, invest in education and skills to remain relevant

The personal finance answer to artificial intelligence is to invest in your education, skills and knowledge.

There's no shortage of good ideas for improving the U.S. retirement system

From Jimmy Carter's administration to a bipartisan proposal in 2023, many lawmakers and economists have tried to help Americans save money for their senior years.

Time is a scarce resource, so choose a resolution worth the effort

The dawn of the New Year is an irresistible time for retrospection and prognostication.

Continuing to invest in your human capital will boost your finances later in life

More people in the second halves of their lives are embracing late-life jobs and careers, which can bring both income and meaning.

What aging parents can do now to help their adult children care for them later

About one-quarter of U.S. adults belong the sandwich generation, according to Pew Research Center. This group has to juggle caring for children and older parents all while still working.

Conversations with family, friends are critical to estate planning

Your will, estate plan and end-of-life wishes will communicate to your loved ones what to do with your assets after your death.

Employ 'creative thoughtfulness' to avoid overspending this holiday season

Two out of every three surveyed in Thrivent's 2024 Holiday Spending Survey expressed concerns about how they'll manage their holiday expenses this year.

Assess your financial risk before new policies affect the economy

The Trump administration comes into power with many policy goals, including economic initiatives like enacting significant tax cuts; imposing broad-based and significant tariffs; sweeping raids, mass deportations and tighter immigration controls; and slashing federal government regulations.

![DAVID JOLES • djoles@startribune.com - Dec. 18, 2010-Eden Prairie, MN-] A Salvation Army bell ringer who grew up playing in the Sal](https://arc.stimg.co/startribunemedia/OYAASA23LA5UR6IOWXQVBNNK6A.jpg?h=120&w=180&fit=crop&bg=999&crop=faces)

Consider charitable giving or volunteering this holiday season

Gifts at the end of the year might qualify for tax benefits.

More employer benefits supporting workers with student loans could ease stress

Student loan debt totals more than $1.7 trillion, with some 92% in federal loans across 43 million borrowers.

How sustainability leads to frugality

When exploring how to live more sustainably, being more frugal with money is often the answer.

Contemplating 10 jobs you'd work for a year each can help uncover next career

Thought exercises like 10 in 10 are worthwhile at any time, but they can be particularly valuable during major life transitions. We're living longer and healthier, and the gift of longevity offers an unprecedented opportunity to imagine what we might do next.

Purpose and work are not mutually exclusive: Find meaning and a paycheck at your job

Personal finance decisions become easy once you understand your "why."

Medicare open enrollment starts soon. Here's how to save money without sacrificing coverage

When it comes to your health care coverage, it pays to research your options and comparison shop because you might save money while doing a comprehensive review that ensures coverage for your health care.

Each stage of life poses new decisions, from career choices to burial options

Retirement can feel like an abstraction to young people but comes into sharp focus as you age.

Have millennials finally caught up economically with earlier generations?

A few years ago, every indication showed the generation had a ways to go on economic factors.

Does it still make sense to buy and own a home?

For first-time home buyers, the cost-benefit analysis has gotten more complicated with interest rates.

Don't flirt with risk when 'boring' index funds could be a safe bet

Take a page out of statistician and professional poker player Nate Silver's latest book, in which he discusses the power struggle between the "River" and "Village" communities of investment thought.

Time-tested solutions for eliminating your credit card debt

There are increasing signs more people are feeling financially strained by credit card debt.

Minnesota's auto-IRA can help workers save for retirement even without employer plans

The Secure Choice Retirement Program should become effective next year and would mean employers without a retirement savings plan must auto-enroll employees in a retirement savings plan.

Plan for potential long-term care in your senior years in terms of family and finances

Medicare doesn't pay for most long-term care charges.

How working from home can help save you money

One economist argues those who telecommute at least half the time save $6,000 a year.

In an election year, keep your finance game plan simple

Recent polls show a tight race for the White House between Donald Trump and Kamala Harris, and the outcome of the election will have major implications for economic policy.

Don't forget the fiduciary standard when picking a financial advisor

The fiduciary standard binds many financial advisors and is in the nature of their professional certification and business practice.

Don't be one of many Americans without 'rainy day fund' for emergencies

A Federal Reserve Bank of Minneapolis survey showed as of October 2023, just more than half of U.S. adults had enough savings to cover three months of expenses if they lost their primary source of income, down slightly from a year before and substantially below the pandemic high.

![A model home in the Summerlin neighborhood of Woodbury. ] AARON LAVINSKY ï aaron.lavinsky@startribune.com Home sales in the Twin Cities metro dur](https://arc.stimg.co/startribunemedia/BK3O7NY5RVO7B7XWMNTBF36MZ4.jpg?h=120&w=180&fit=crop&bg=999&crop=faces)

The housing market is leveling: Buyers, time to put your finances in order

Since you can't predict the future course of home prices, potential homebuyers should focus on what they can control: Their money.

Congratulations, graduates. Now it's time to come up with a financial plan.

You should start saving with your first paycheck, especially with today's work life of multiple jobs.

The clock is running on finding a fix for the Social Security system

Social Security's trust fund can pay benefits in full only until 2033, according to the 2024 Trustees Report. Once that date of funding depletion comes, Social Security will pay only 79% of promised benefits.

Making a living as an artisan is hard but not impossible with financial planning

Becoming a furniture-maker or blacksmith can be a passion pursuit as well as a lucrative career if you keep money matters in mind.

Keeping personal finances simple can improve your well-being

Practical steps include automating the movement of money from checking into savings accounts, similar to automatic withdrawals from your earnings into retirement savings at work.

Biden's new income-driven repayment plan could be boon for those with student loans

SAVE (Saving on a Valuable Education) changes the definition of discretionary income to increase the number of low-income borrowers eligible for $0 payments and subsidizes any unpaid interest that remains after a borrower makes a payment.

These three simple reminders can help you avoid a scam

The Federal Trade Commission said people lost more than $10 billion to fraud in 2023, up from $3.5 billion in 2020.

Chris Farrell: Ageism shouldn't prevent retirement-age people from working

Whether and how to earn an income is critical to retirement planning, and for employers, older workers are a valuable asset to keep and to hire.

Farrell: Having traditional and Roth savings gives you tax-savvy options in retirement

If your income will be lower in retirement than when you were working, you'd favor traditional retirement savings. Roth is better for the reverse. Since you don't know, the advantage of having both is flexibility.

Chris Farrell: Be skeptical of new retirement-saving strategies

Many experts have published different ways to save through the years, but none seems to beat standard advice.

Chris Farrell: Warren Buffet's annual wisdom-sharing full of personal finance advice

Berkshire Hathaway is the seventh-largest U.S. company with a market capitalization of nearly $900 billion, but lessons from its founder are still relatable.

Chris Farrell: Productivity growth has led to our economic growth

Productivity growth is a key measure of economic prosperity, job creation, innovation and quality of life for individuals and society.

Chris Farrell: America's retirement system is failing too many people

The lack of savings doesn't reflect the lure of shopping on credit or a lack of financial education. Instead, too many workers live on low and unstable incomes, while too many moderate-income families struggle to pay their bills.

Chris Farrell: Index funds can help you reach your retirement goals

The so-called "passive" investment revolution is a smart way for individuals to invest for the long haul despite critics' arguments.

Beware of Bitcoin investing

Cryptocurrencies are speculations without any intrinsic value.

Make caregiving a financial priority

Few of us have sufficient resources to rely solely on savings for dealing with children or aging adults coping with mental and physical infirmities.

Finding your purpose for everyday living

The fundamentals of personal finance are especially important during major transitions.

There are benefits to working at an older age

Instead of thinking about retirement, try exploring what portfolio of activities comes next.

There is more to charitable giving than a tax break

When we give away money, we're actively showing what matters to us.

Farrell: When you retire, should you keep your money with your employer's 401(k) plan?

There are several factors to weigh, and current research on when it may be a good idea.

Farrell: The American housing market is broken

The need for more affordable-housing options is now part of a much larger conversation about economic development, economic growth and quality of life.

Caregivers need more social and financial support

Financial planning increasingly means taking the time to build into future scenarios the prospect of needing long-term care from family or close friends.

If you didn't save for retirement when young, is it too late?

You can't go back in time, but there's no reason for despair.

Cryptocurrency is too volatile for it to be a big part of your retirement plan

Boring is a virtue in retirement savings; the tried and true vehicles are used a lot for good reason.

Make sure you are spending enough in retirement

Many retirees who consistently saved over the years spend less than they might in retirement.

Staying the course isn't always easy

Why trading is hazardous to your wealth and managing risk is critical.

Chris Farrell: Employers can help increase financial understanding

Skills can be improved with education on the job.

Savers owe plenty to Nobel laureate Harry Markowitz

He encouraged investors to focus on diversification, while adjusting the mix of assets for risk.