Opinion editor's note: Editorials represent the opinions of the Star Tribune Editorial Board, which operates independently from the newsroom.

•••

In the opening scene of the 2024 action movie "The Beekeeper," a woman is in a phone conversation with a man who says her computer has been compromised. In a soothing, reassuring yet official-sounding voice he tells her that he can help protect her from losing everything on her laptop.

Worried about losing important account data, she gives him password information, and a few keystrokes and minutes later, the man drains all the woman's accounts down to zero — including one for more than a million dollars from a nonprofit she helps manage.

That's an extreme, dramatic, fictional example of what can happen to people when they are hit by online or telephone scammers. It is, however, a version of what happens all too often in smaller amounts these days to American consumers. Impostors have become much more sophisticated in the ways they can separate you from your money, and they've succeeded in stealing billions.

That's why, in a world in which almost everyone conducts some sort of business electronically, consumers must be especially vigilant to protect their identities and accounts. And we must use the variety of tools that are available to help.

A bit about the scope of the problem: A Federal Trade Commission (FTC) report from earlier this year shows that consumers reported losing more than $10 billion to various types of fraud in 2023 — a 14% increase over reported losses the previous year and the highest amount ever. Of that total, people reported losing just above $4.6 billion to investment fraud — more than any other category.

However, the second-highest amount (nearly $2.7 billion) came from impostor scams. That area saw significant increases in reports of both business and government impersonators.

Another FTC report listed the Top 10 companies that U.S. consumers reported for impersonating their representatives. Among them are Comcast/Xfinity, Amazon, Apple and Richfield-based electronics retailer Best Buy.

A recent Star Tribune column by business writer Nicole Norfleet documented how she was taken in by a scammer claiming to be from Comcast/Xfinity who could take her monthly payment by phone. And an editorial writer, who has received so-called "urgent" notices from at least three of those top 10 businesses, found the online fake documents to look almost exactly like receipts or other real correspondence from the companies.

In an interview with an editorial writer, Bao Vang, communications vice president for Better Business Bureau in Minnesota and North Dakota, said she advises consumers to do research on businesses before buying, avoid offers that sound too good to be true and to use secure and traceable payment systems.

And the Minnesota Attorney General's Office told an editorial writer that the false sense of urgency that thieves use to intimidate victims is a big red flag. Take the time to double-check to see if a utility or service shut-off call is legitimate, and use the prevention tips from the state.

Both the BBB and officials in the Attorney General's Office say people shouldn't feel ashamed about being deceived and that it is important to report scams. Even if you don't receive a response about your reports, they're of value. Reports can be made to FTC at ReportFraud.ftc.gov and BBB Scam Tracker.

The BBB "meets quarterly with government officials, and we share information to track trends and patterns," Vang said. "There is so much shame and embarrassment — but that doesn't help the next victim. Know that there is power in telling your story. … Education is the best defense against scammers."

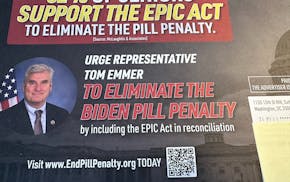

Burcum: About that so-called 'pill penalty'