Even from his cell in Leavenworth, prisoner 14170-041 continues to haunt Minnesota, this time at the state Legislature.

Tom Petters, who's incarcerated for 50 years for one of the largest Ponzi schemes in American history, donated millions to charities and religious organizations before his scam was uncovered. A measure buried in a state budget bill would limit the funds that cheated investors could recover from those groups.

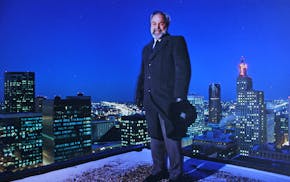

Over the past decade, Minneapolis attorney Doug Kelley has pursued institutional investors, individuals and about 30 charities that got money from Petters and prompted all but three of them to return millions that originated with Petters' ill-gotten gains.

The measure in the Legislature would allow the three remaining charities to keep the millions they gained from investing securities given to them by Petters. The charities are the Minneapolis Foundation; the Northwestern Foundation, affiliated with the University of Northwestern, a Christian college in Roseville; and the Sabes Foundation.

While the law change was included in a larger bill vetoed by Gov. Mark Dayton, Kelley expects the exemption to return. Kelley said the measure was sponsored by Rep. Greg Davids, R-Preston.

Kelley says it seems tailored to save the charities about $35 million in total, money that would come out of the pockets of "real people on the other end of the equation," which includes teachers' pensions and elderly investors. Kelley added that he has made deals with charities that didn't know about the fraud and couldn't afford to pay the money back.

"I'm not in the business of putting charities out of business," Kelley said.

Last year a federal judge sided with Kelley, ruling that money paid to investors, participants and charities was all gotten illegally, and thus "stolen from other participants." Kelley says this bill, if passed, would essentially negate the judge's decision.

But Grover Sayre, a board member of Northwestern, said the new amendment would simply clarify a bipartisan bill passed in 2012 that exempted charities from "clawbacks" after two years. He said the amendment would specify that securities, such as a promissory note, would be included in that two-year window, not just cash. He said the school has lobbied for the amendment.

Sayre said that convicted fraud participant Frank Vennes gave the school a $2 million promissory note that turned into a $5.5 million payoff from Petters three years later. At the direction of Petters, the school donated most of the money to other charities.

"That money is long gone," said Sayre. "If Doug goes after our foundation, with a net worth of $5 million, it would wipe us out."

The Ponzi scheme didn't get uncovered for eight years. "If all those big investment firms didn't know it was a fraud, how could a charity?" Sayre said.

According to Kelley, anyone who "knew or should have known" the money was fraudulently obtained has to give it all back. If there were "red flags" that signaled fraud, they were obligated to ask more questions, Kelley said.

Kelley said the school should have had more questions about Vennes, who was previously convicted of selling cocaine, illegally possessing weapons and money laundering. The other red flag was the exorbitant interest rate on the note.

In the case of the Sabes family, Kelley said they ran a sophisticated investment firm at the time, and owned other businesses including a casino and strip club. The Sabes family made more than $200 million on the Petters pyramid scheme over many years, Kelley said, and bailed out before it crashed.

Court testimony and secret recordings of Petters in the final days of the scam indicate that Bob and Jon Sabes confronted Petters and demanded their money back before he was indicted. Petters was recorded expressing fears that the Sabeses were affiliated with organized crime after he paid former Minnesota Attorney General Mike Hatch to investigate them. Petters repeatedly told his co-conspirators he feared he would be killed over the money.

When asked about the organized crime allegations in 2011, Rob Sabes said of Petters: "I think he's been watching 'The Sopranos' too much." Jon Sabes testified he didn't know Petters was running a scam.

John McDonald, an attorney for the Sabeses, declined to comment.

When charities balk at paying donations back, Kelley tells them that the bankruptcy laws seem complicated on clawbacks, but the ethics behind them aren't. "If a bank robber robs a bank and walks across the street and puts the money in a collection box, it's still stolen money," Kelley said. "Even if it was eight years later, the law says you have to pay it back."

Either way, says Sayre, more people get hurt by the Petters scam.

"If [Kelley] gets the money from us, it will create a whole new set of victims," he said.

jtevlin@startribune.com • 612-673-1702

Follow Jon on Twitter: @jontevlin

Depressed after his wife's death, this Minneapolis man turned to ketamine therapy for help

Tevlin: 'Against all odds, I survived a career in journalism'