St. Paul and Ramsey County have given away more than $12.7 million in emergency grants to about 1,300 small businesses hit hard by the pandemic, with leaders emphasizing the need for both speed and equity in distributing those funds.

Despite efforts to be fair — St. Paul used a blind lottery system, Ramsey County funded every qualified applicant in the first two rounds and both promoted their programs in multiple languages — some historically underserved areas of the capital city still came out behind.

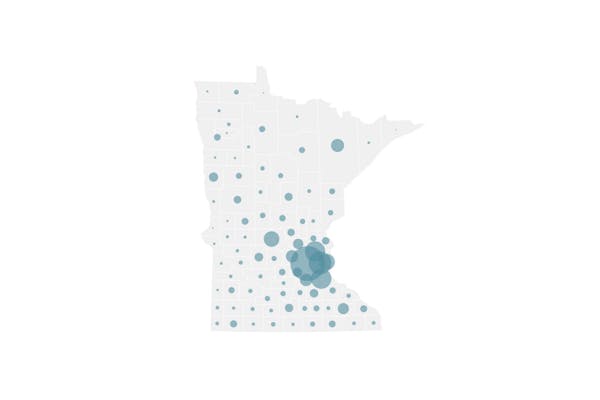

A Star Tribune analysis of city and county data found that while businesses throughout St. Paul benefited from the St. Paul Bridge Fund for Small Businesses and the Ramsey County Small Business Relief Fund, awards were sparser in some of the city's poorest areas, including the East Side and North End.

Nearly 90 businesses in St. Anthony Park, with a population of less than 9,000, received a total of at least $850,000. Meanwhile, in the Greater East Side and Eastview-Conway-Battle Creek areas, with a combined population of more than 53,000, about 80 businesses received about $690,000.

About 50 businesses in the Summit Hill neighborhood, with just 7,000 residents, received about $450,000; slightly less than the $506,000 received by the businesses that serve the North End, including Rice Street, which has a population three times that size.

"We didn't hit the mark," said Paris Dunning, executive director of the East Side Area Business Association. "When I look at the numbers, we missed our share."

City and county officials, who ran their programs independently of each other, say they worked hard to distribute aid throughout the city. They also acknowledge the challenge of overcoming entrenched inequities.

"Unfortunately, due to generations of racist policies and disinvestment, some of our neighborhoods have more small businesses and more successful commercial districts than others," said Ramsey County Commissioner Trista MatasCastillo, who represents the North End.

St. Paul Mayor Melvin Carter said the Bridge Fund is just one of several initiatives designed to help families, businesses and neighborhoods weather COVID-19.

"Our goal is to field an entire portfolio of crisis relief efforts that touch every corner of our city. I am confident that is what we are doing," he said. "I don't think there is any such place as enough where COVID crisis relief is concerned."

Advocates in the East Side business community said resource gaps between neighborhoods affected who knew about the programs and who applied.

"We tried desperately to get the word out. We discovered this huge digital divide," said Anne DeJoy, executive director of the East Side Neighborhood Development Co., which was contracted by the county and its partners to promote the program and help businesses apply. "If I have a nice little restaurant in St. Anthony Park, I could probably pay my tax accountant a couple hundred bucks to fill out applications for me."

That wasn't an option for many East Side small-business owners, DeJoy said, some of whom run their entire operations through their smartphones and didn't have computer access or the documents required to apply for the county program.

East Side community leaders, including Council Member Jane Prince, said possible explanations for the disparities — that business owners didn't hear about the programs, struggled to apply or simply are few and far between — are disquieting.

"We really have had to fight tooth and nail for any dollars that come this way," said Lisa Theis, interim executive director of the Greater East Side Community Council. "We do have quite a few small businesses. I don't think there was a lot of engagement on it, to be honest."

Dunning, of the East Side Area Business Association, said he'd like to partner with the city and county to attract more applicants from East Side neighborhoods. He also said it's not just elected leaders who are responsible for engaging and reviving those neighborhoods, and that he and the business community have to own their shortcomings. "We can do a better job," he said.

East Side Bar on Payne Avenue opened for business in March, the day Gov. Tim Walz ordered a statewide shutdown. Because they'd just opened, they didn't qualify for the city program, said owner Eric Foster.

The business did qualify for a state grant, Foster said, and is also in line for a county grant.

He said he doesn't fault the city or county for moving swiftly, and he knows his counterparts along University Avenue faced double the pain with COVID-19 and then the civil unrest following the police killing of George Floyd.

"If you set up a situation where you are balancing by neighborhood, that just makes it more complicated and hard to get the money out the door," Foster said.

The city of St. Paul was one of the first in the state to create an emergency assistance fund days after Walz's shutdown order.

Council Member Chris Tolbert said the city, sensing the dire situation for small businesses, didn't wait for state or federal funds. Instead, they scrounged together an initial pot from existing city coffers. The application was a simple two-pager, translated into multiple languages, that could be filled out online or over the phone. Hired translators helped answer questions by phone.

All 2,100 businesses that met basic qualifications were assigned a lottery number, and checks went out on a rolling basis.

The city has so far distributed $7,500 grants to about 550 businesses for a total of nearly $4.2 million. Tolbert said slowing down distribution and adding layers of requirements seemed like a wrong move that could result in businesses closing for good.

"I think this is the fairest possible way," he said.

Small-business owners including Kathy Sundberg say that fast infusion of cash from both the city and county made a difference. Sundberg, who owns Ginkgo Coffeehouse, said the money helped keep her staff employed and doors open.

"It takes a lot of the pressure off trying to make sure we can pay all the bills," said Sundberg, who has owned Ginkgo for nearly three decades and lives blocks from her Snelling Avenue storefront.

Ramsey County launched its $15 million small-business fund in the spring using federal CARES Act dollars, with grants of up to $15,000. So far, about $8.6 million has gone to St. Paul businesses, with more going to suburban businesses and about $3 million still to be distributed. Applications for a new round open Monday.

The county worked with nearly a dozen diverse community partners, said Kari Collins, the county's community and economic development director, and about half of the small businesses that got grants were owned by people of color.

And East Side businesses have benefited, including in the Payne-Phalen and Dayton's Bluff neighborhoods, which appeared to have strong participation in both programs.

More than 70 vendors who listed Hmong Village on Johnson Parkway as their business address received emergency grants. That's because the owners of the mall offered assistance, helping vendors fill out paperwork and scan documents.

Mai Her, Hmong Village operations manager, said most of the mall's more than 200 vendors applied for grants.

But she said small-business owners are still hurting.

"In order for our businesses to survive," Her said, "we will need more grants to really help these small-business owners."

Staff writer C.J. Sinner contributed to this report.

Want to share info with the Star Tribune? How to do it securely

'Safe recovery sites' would offer syringes, naloxone and more to people using drugs. The plan could be in peril.

New Minnesota GOP leaders seek peace with party's anti-establishment wing

Who is Republican Lisa Demuth, Minnesota's first House speaker of color?