If there is one investment firm in town that can appreciate the history of Minnesota public companies, it is Mairs & Power in St. Paul.

The firm has achieved a great deal of acclaim over the years through one of the longest-running mutual funds in the country, the Mairs & Power Growth Fund.

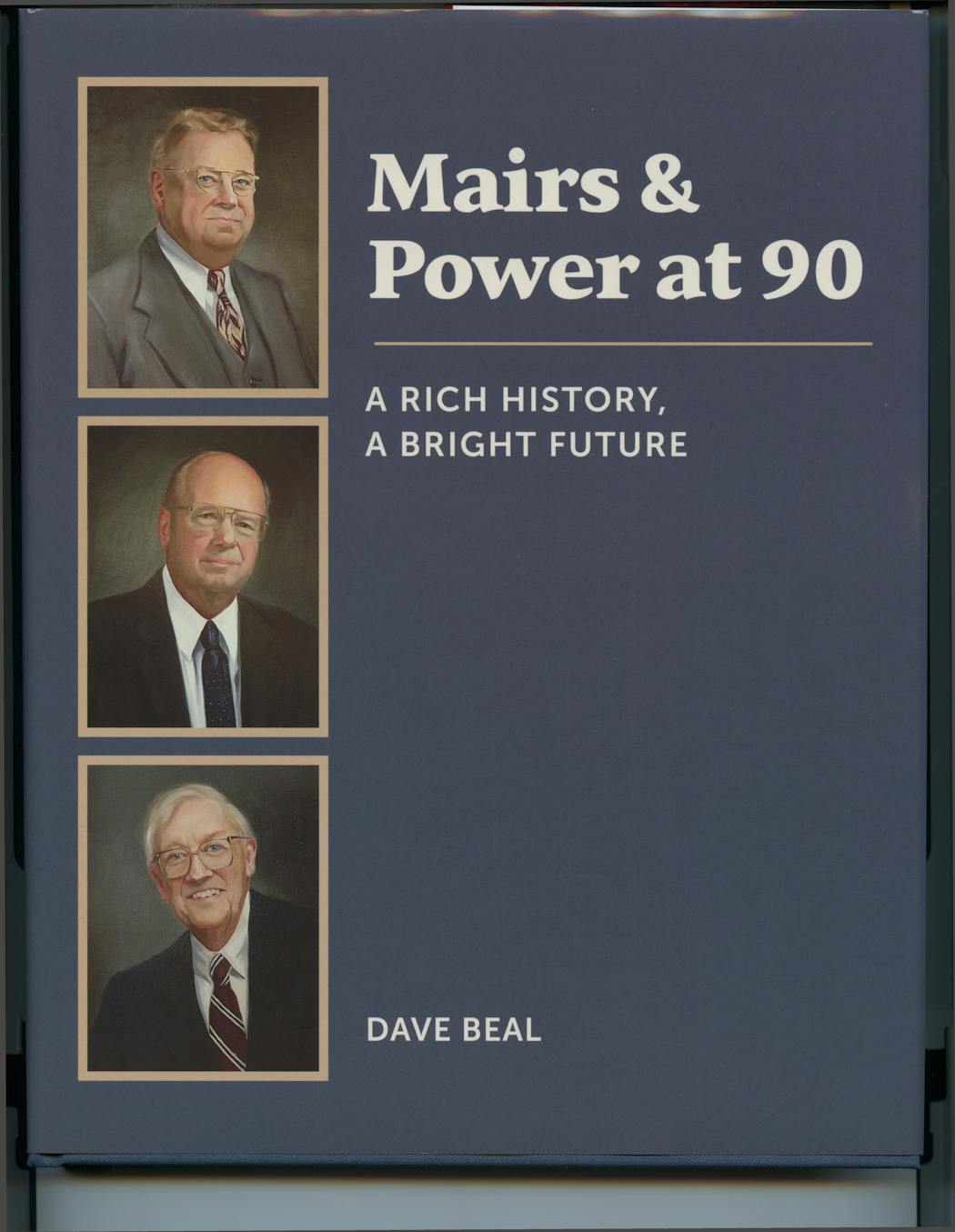

To celebrate its 90 years in business, the firm commissioned former Pioneer Press editor and business columnist Dave Beal to write its history. The plan was a 75-page pamphlet. Because of Beal's storytelling skills, the project morphed into a 200-page book, "Mairs & Power at 90: A Rich History, A Bright Future."

The Mairs & Power Growth Fund is well known for investing in Minnesota firms that helped shape the area's diverse business landscape. In 1998, nearly 80% of the companies in the fund — making up 80% of its value — were based in Minnesota.

"Part of the reason to me that it's such a good story is that they have survived independently for so long in such a turbulent business," Beal said.

The book chronicles more than the firm. It describes migration to Minnesota, how historic businesses developed here and how trends in investment management changed.

Beal also profiles the firm's principals and covers diversity in the investment industry and the influence of the First Trust Co. of St. Paul on the Minnesota investment community.

Beal did much of his research from home during the pandemic with help from the book's publisher, the Ramsey County Historical Society, and the archives of the Minnesota Historical Society. He also poured over troves of documents from the company, plus family and client records.

George Mairs Jr. started the firm in 1931 to invest his own money plus the wealth of a few other families. George Power Jr. joined in the mid-1940s, starting to build the firm's assets by courting individual accounts. In the early 1950s, George Mairs III joined the firm and persuaded his father to start the Growth Fund in 1958.

For much of its history, Mairs & Power was a pretty bare-bones operation. The principals did much of the firm's administrative work themselves.

However, the company steadily grew and now manages more than $12 billion for pension plans, endowments, private accounts and through three mutual funds (growth, balanced and small cap). Today the firm is also expanding into exchange-traded funds based on Minnesota municipal bonds and recently started a venture capital fund focusing on companies in the Upper Midwest.

George Mairs III retired in 2007, and the firm has made a successful transition from a family-owned to an employee-owned firm.

Current CEO Mark Henneman joined the firm in 2004 and spent hours codifying the investment style of George Mairs III that had proven to be successful for decades. He and others then built on that framework. He also commissioned the book project.

"I wanted to make sure the culture that was created by our founders is part of our permanent record," Henneman said. "At some point, you are going to have a Mairs & Power without anyone that ever knew" George Mairs III.

While the stocks the firm invests in have changed, the core tenets of the investment philosophy remain. The firm does bottom-up research, prefers to meet with management teams directly, keeps turnover in their funds low, invests for the long-term, and still favors many Minnesota public companies.

Values laid down by the firm's founders will continue to help it grow.

"They still do regional investing. And I don't think there's anybody else, according to Morningstar, that does this, " Beal said. "Mairs & Power isn't doing it as much as they were, but they're still doing it."

Minnesota Department of Health rescinds health worker layoffs

Eco-friendly house on 30 acres near Marine on St. Croix listed at $1.6M

DOGE cuts federal money for upgrades at Velveeta plant in New Ulm