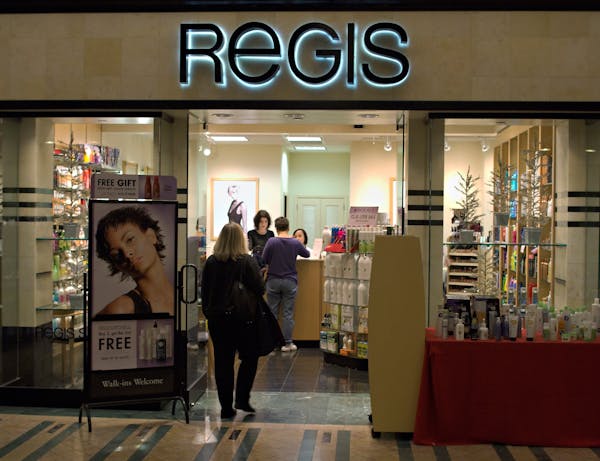

Regis Corp. is buying 314 strong-performing salons, mostly Cost Cutters and SuperCuts, from its larger franchisee, which wants to exit the hair and beauty business.

Minneapolis-based Regis will pay the franchisee, Michigan-based Alline Salon Group, $22 million for the salons, despite trying to convert to an all-franchise model. Regis has spent years under several CEOs on the shift. In its first quarter ended Sept. 30, Regis had nine company-owned salons and 4,350 franchise-owned salons.

But Matthew Doctor, Regis' CEO, said there are strategic benefits to owning this group of salons.

"As we have entered a new chapter at Regis, we felt being closer to salon operations was important as we look to drive sales and profitability for our franchisees," he said.

With the acquisition, Regis will still have 93% of its salons owned by franchisees. The 314 salons from Alline Salon have total annual revenue of $83 million and $5.8 million in profits.

Alline Salon Group formed in 2018 and quickly acquired Regis salons in 2018, 2019 and 2020. At one point, it owned 389 salons across seven states. As it battled through the pandemic mandates, it closed underperforming salons and converted many to the SuperCuts or Cost Cutters brands, which also are run by Regis.

Alline had nine partners, including CEO Mike Sarafa. The group was ready to leave the salon business after nearly seven years, Sarafa said. The group had been shopping for a buyer for about six months before Regis stepped in to purchase the salons and back-office operations.

"They were looking to get back into, in a modest way, the corporate operations of salons," Sarafa said in an interview. "We have the back office set-up, a turnkey operation, ready to go with very good people in place. It will be an easy transition."

Sarafa said Alline employees will remain in place for now and have more career growth opportunities in a larger environment.

Alline could earn an additional $3 million from the transaction based on performance over the next three years.

Sarafa said he and his partners were pleased with the sale and have been pleased with their relationship with Regis. But the pandemic years made the business tougher.

"It's a different industry today than it was five years ago," Sarafa said.

On Nov. 29, 2023, Regis completed a 1-for-20 reverse stock split to maintain its listing on Nasdaq and in June it completed a major refinancing.

It was a multiyear effort to complete the transformation to an all-franchise model, and while salon performance has stabilized systemwide, sales in its first quarter fell 6.8% to $285.6 million and it recorded a net loss of $900,000. However, adjusted earnings per share were up 31% to 93 cents a share.

"Much work remains, but I believe strongly in the initiatives we have in place to return Regis to long-term, sustainable growth," Doctor said in the company's first quarter earnings release.

Thanks to improving performance from the franchised salons and the refinancing, Regis' stock is up 150% this year. It was trading around $5 a share at the June refinancing, and closed Wednesday at $21.95. Regis shares closed Thursday at $23.62, up 7.6%.

UnitedHealth sues the Guardian, alleging defamation in coverage of nursing home care

Prices for international flights drop as major airlines navigate choppy economic climate

Minnesota's med spa industry rises in popularity — and with little regulation

Hundreds line up at Best Buy to nab Nintendo Switch 2, in scene like '90s opening parties