Why does Minnesota have municipal liquor stores?

Listen and subscribe to our podcast: Via Apple Podcasts | Spotify | Stitcher

Many Minnesotans buy their alcohol directly from the government at city-owned liquor stores across the state, a Prohibition-era arrangement that reader Tim Bulfer has been pondering a lot lately.

That is because he recently moved to Wisconsin, where cities stay out of the liquor business.

"It was a big culture shock moving to Wisconsin," Bulfer said. "Somehow, [Minnesota] cities have ended up in the vice business. It's like if you had to buy your cigarettes from a government-owned cigarette store. It doesn't really make sense."

Bulfer sought answers from Curious Minnesota, the Star Tribune's reader-powered reporting project, about how Minnesota got its "munis."

State-run liquor stores are the norm in many areas across the country — known as "control states" — that chose to oversee sales when national prohibition was repealed in 1933. Some control states only manage wholesale liquor transactions. But Minnesota has a unique hybrid model that lets cities choose whether to have a monopoly over liquor sales within their boundaries.

Just three other states — Alaska, Maryland and South Dakota — have a hybrid model where control varies among local jurisdictions. Minnesota's unusual approach means it has more municipal liquor stores than any state in the country, according to Paul Kaspszak, the executive director of the Minnesota Municipal Beverage Association (MMBA).

Making the munis

Minnesota's munis date back to 1933, when the repeal of the 18th Amendment spurred the rewrite of state liquor laws. Counties held referendums on whether to be wet or dry, but cities insisted that they — rather than the state — controlled how liquor was sold.

"The local community is best able to cope with the situation," said Detroit Lakes Mayor A.E. Knudson, according to the Minneapolis Tribune. "The liquor problem affects the home community first ... It is an infringement on the rights of the municipalities and home rule if we are to place the control of this problem in either state or national governments."

The act allowed cities with populations of 10,000 or fewer to establish a store selling alcohol by the bottle or consumption on the premises. Cities with larger populations can establish a municipal liquor store today, but they must go through the Legislature.

Many cities passed resolutions establishing municipal liquor stores in the 1930s and 1940s to maintain control over the sale of alcohol.

"Coming right off of prohibition, where they're pouring booze down the drains, by owning and operating the community alcohol business, you can control how that business is going to be operated," Kaspszak said.

Municipal liquor stores became a prominent debate topic in local elections in the 1940s. Many people wanted to ensure alcohol was sold safely under the community's standards. But revenue also proved to be a strong incentive, since profits could fund community projects and causes.

Ten communities in Polk and Chisago counties voted to approve municipal liquor stores in 1948, for example. Many voters were in favor because they wanted to use the profits to "light up a ballpark" in Wilmont or fund a new sewer system in Ellsworth, according to Associated Press coverage.

Initially, counties could overrule cities seeking to establish a municipal liquor store. But this changed with a new state law in 1957.

A community service

Across the country, the government oversees the distribution of certain kinds of alcohol in 17 states.

This can range from control of the sales of all alcohol in Utah to the distribution of spirits in Vermont. Unlike control states, individual communities in Minnesota set the bar for what they sell and how they use the money.

Minnesota municipal liquor stores are seeing an increase in net profits overall, bringing in $36.5 million in 2021, according to the Minnesota State Auditor's office. A large portion of this came from metro area businesses. In 2021, Apple Valley Liquor stores led the pack in net profits, transferring almost $1.7 million into the city's general fund.

The picture is different in other parts of the state, however. Among the 13 stores that lost money in 2021, 12 were located in greater Minnesota.

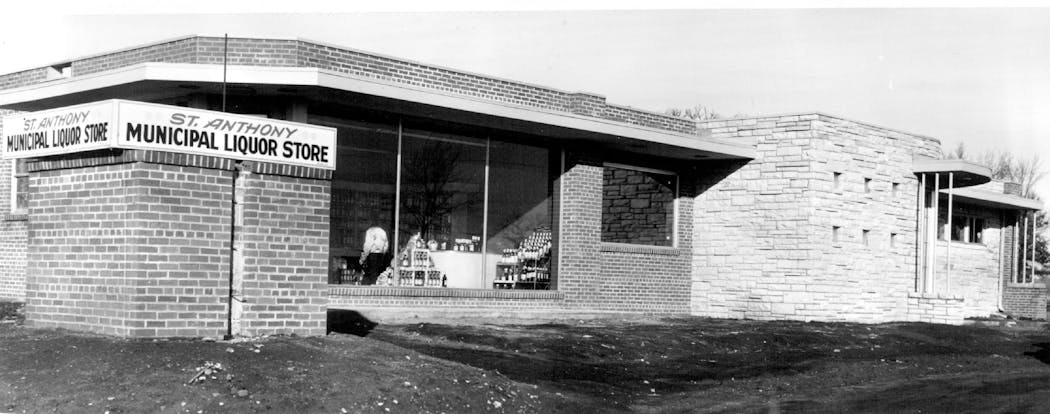

Mike Larson, manager of St. Anthony Village Wine & Spirits, sees his business as a public service. He said the store — where he has worked for more than three decades — is committed to carefully controlling how liquor is sold in the community.

His business does not sell any product marketed to a younger demographic, for example, including alcoholic ice pops and Hard Mountain Dew (before its discontinuance).

"As a manager that reports to the mayor and the council, the last thing I want is someone to have this in their freezer or fridge and a minor gets ahold of it," Larson said.

'Mini city hall'

Cities vary widely in how they choose to spend their profits. In many cities, including Wayzata and St. Anthony Village, alcohol purchases fund park maintenance, new snow plows and road work.

In Bagley, the city is using the revenue to pay off the loans for the construction of the new liquor store. Bagley Liquor's manager, Chris Arnold, says it is in residents' best interest to support the store because of the revenue it brings in.

Bagley Liquor and other greater Minnesota municipal liquor stores are often places where people gather and come into contact with the government.

"These stores are a community asset," said Kaspszak of the MMBA.

Larson describes St. Anthony Village Wine & Spirits as a "mini city hall" because it's where some customers come to discuss what is happening in town.

"With the community you serve, you are representing your city, not just selling booze," Larson said.

Maya Marchel Hoff is a University of Minnesota student reporter on assignment for Star Tribune.

If you'd like to submit a Curious Minnesota question, fill out the form below:

Read more Curious Minnesota stories:

Why can't Minnesotans bypass the Legislature to change state laws?

Why do we have water towers and what do they do?

Why do gas prices vary so much around Minnesota?

Why is Minnesota the last state with 3.2 beer?

Why doesn't Minnesota charge a sales tax on clothing?

640th Avenue? 180th Street? The backstory behind long rural addresses