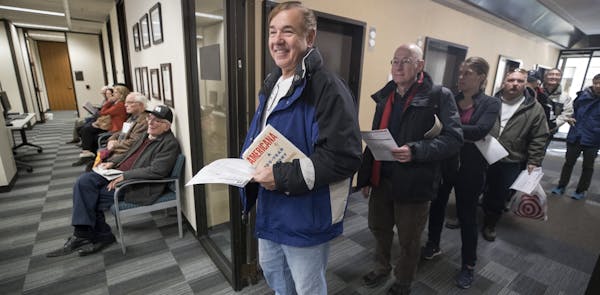

Ramsey County is joining Hennepin County in extending its office hours for residents wanting to prepay their 2018 property taxes in hopes of claiming them as a deduction.

Ramsey County officials announced Thursday that they will open the county's Property Tax Services office from 8 a.m. to noon Saturday to accommodate the expected surge of taxpayers. The office will be open Friday during regular business hours, 8 a.m. to 4:30 p.m.

Ramsey County handled 893 prepayments from Tuesday to Thursday, more than twice the number it handled in all of 2016.

The scramble to pay the taxes in advance was prompted by the newly enacted federal law that will cap the annual state and local tax deduction at $10,000 as of Jan. 1. That change could cost some taxpayers thousands of dollars, but it still wasn't clear Thursday who may be able to deduct their taxes through prepayment.

Hennepin and Ramsey County officials couldn't say for sure whether 2018 prepayments ultimately will be deductible. They directed questions along that line to the state Department of Revenue, where on Thursday a spokesman said department officials were reviewing how the Internal Revenue Service's "guidance on property tax prepayments" will affect Minnesotans.

In the meantime, state and local officials advised homeowners to consult a tax professional for advice as to whether they should prepay their taxes.

In Ramsey County, prepayments can be made in person, online or by mail, although postmark dates won't be honored. The deadline to pay in person in Ramsey County is noon Saturday, and the online payment deadline is 11:59 p.m. that night.

Checks used for prepayment should have "2018 Prepayment" and the property ID (PIN) number written on the memo line. Full payment instructions can be found at ramseycounty.us/paypropertytax/.

Hennepin County officials said Wednesday that they were extending their weekday hours from 8 a.m. to 5:30 p.m. and adding a 9 a.m. to 2 p.m. window on Saturday to handle the surge of in-person taxpayers.

Kevin Duchschere • 612-673-4455

Want to share info with the Star Tribune? How to do it securely

'Safe recovery sites' would offer syringes, naloxone and more to people using drugs. The plan could be in peril.

New Minnesota GOP leaders seek peace with party's anti-establishment wing

Who is Republican Lisa Demuth, Minnesota's first House speaker of color?