It's been a year of economic contradictions for the country, but Minnesota's biggest one ended this week.

The finances of the state government for so long appeared to defy the slow performance of the Minnesota economy. No more.

The news came like a cold splash in the face to government leaders. I hope it will lead more of Minnesota's government and business leaders to squarely confront that the state is no longer the exceptional economic performer it was when they were young.

Minnesota remains a wealthy state in strong fiscal shape. However, it is growing more slowly than any time in its history and is constrained by labor scarcity that's also without precedent.

That reality was not being given much thought when the Legislature, led by Democrats and buoyed by a record $17 billion revenue surplus that had accumulated since 2021, this spring agreed to the biggest jump in state spending since the 1970s.

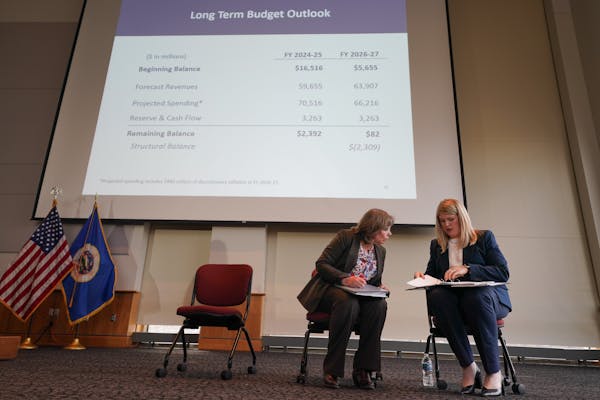

On Wednesday, the state budget office's newest outlook showed that the huge jump, coupled with Minnesota's slow growth, will create a problem.

It will lead to a structural imbalance in 2026-27 that, all else being constant, would have to be covered by the $2.4 billion surplus from the current biennium to produce the balanced budget required by law.

Gov. Tim Walz and Democratic legislative leaders, House Speaker Melissa Hortman and Senate Majority Leader Kari Dziedzic, tried to put a good spin on the news. "We are in a solid place," Walz said.

He said he believed that much of the 2024-25 spending will lead to economic growth that will yield greater revenue than the state's budget officials expect in 2026-27. "We're going to see historic job creation," Walz said.

Trouble is, there's not much room to go up.

The state added 29,000 jobs, or 1%, in the 12 months ending in October. A record number of people are working in Minnesota, just above 3 million, and the labor force participation is rate is the fourth-highest in the nation. The overall workforce, including people looking for work, remains slightly below its pre-pandemic peak.

Add to that the ongoing decline in the number of children being born in the state, which peaked in 2007 and has mostly dwindled since. The state's schools are registering that decline now, and employers will see it in a few years.

More immediately, the new outlook means there's no room for Walz and legislators to maneuver on anything new or unexpected. Indeed, everything that's touched by the state's spending is about to become harder.

That includes the future of the University of Minnesota's hospital system. Also, the hopes that the state might rescue school districts as their pandemic-era federal aid ends in 2024. And, the dreams of local governments and nonprofit organizations that the one-time funds they received for the 2024-25 state biennium would extend to 2026-27 and beyond.

And forget about tax cuts.

The development came a day after new federal data revealed that Minnesota's economic growth in the second quarter of this year was 0.7%. That was below the nation's 2.1% growth, as well as each of our neighboring states except Wisconsin.

This gap between the growth of the state economy and the growth of state government spending, as I noted earlier this year, has no precedent in the modern-day budgeting of the Minnesota government that began in 1960. That should have been a signal for prudence.

Of course, the connection between state GDP and the funding or growth of state government is indirect. The income of Minnesotans is the biggest source of revenue for state government, and it has been rising more quickly than the state's economic output.

In the data released Tuesday, the federal Bureau of Economic Analysis reported that the personal income of Minnesotans rose 3.9% in the second quarter. That was a slowdown from the 5.5% rate Minnesota experienced in the first three months of the year.

It was all good enough, however, to raise expectations for income tax collection by about $200 million this year. Corporate tax collection surpassed previous expectations by $250 million, state economist Laura Kalambokidis told reporters on Wednesday.

She also noted that the last forecast on the state's finances, made in February, included the expectation that the U.S. economy would endure a recession this year. "The recession didn't materialize," Kalambokidis said.

Nationally, that's been the biggest economic contradiction of 2023. Inflation came down without a recession and without creating a spike in joblessness. That's counter to economic theories and to the experience of Americans who lived through the 1980s.

The other contradiction is that economic data keep improving, but the perceptions people have about the economy — or "the vibe," as politicians and pundits keep saying — hasn't.

That one may be shaped by politics as much as peoples' lived experiences, however. And we're heading into a year when, like it or not, politics appears likely to dominate our lives.

Ramstad: Gov. Walz, things are not getting done in Minnesota

Ramstad: AI is English-centric, but it's picking up Hmong quickly

Ramstad: Minneapolis' Camden neighborhood is rising. Houston White wants to keep it that way.

Ramstad: Minnesota's big businesses are in crisis with a common problem