Recent content from Ross Levin

Don't consider just your conflicts of interest. Be wary of your advisors', too

Fiduciaries and real estate agents are a few examples of professional personal finance guides to manage.

How to know if buying a vacation home is right for you

Most of us don't consider all the costs of owning a vacation home, both in time and money.

Opposites attract in love and money, which makes for financial tension

Different saving and spending philosophies can become fight-fodder in relationships unless you make a point to talk about it.

Fight, flight, freeze or fawn: How to react to stock market volatility

President Donald Trump's tariffs have sent the markets tumbling down. Manage your money based on your gut reaction.

Know your finances in order to make investing, retirement decisions

You need to learn more about your finances to know which debts to pay down and which investments are best for your situation.

Don't get mad, get control of your financial matters

These are crazy times, from a $6 billion state budget deficit to capricious national government decisions, but making some smart money choices can help.

![Edwin Schall got a dollar from a passerby as he held out a pan t get money for food along Nicollet Ave. ] (KYNDELL HARKNESS/STAR TRIBUNE) kyndell.hark](https://arc.stimg.co/startribunemedia/RQ7TYGVJPSRIC5TPDZ743YFF5A.jpg?h=120&w=180&fit=crop&bg=999&crop=faces)

How donor-advised funds can help you meet your charitable goals

While you might have committed to giving a percentage of your income, giving assets that have appreciated into your funds may be a wiser choice.

In tough financial times, avoid paralysis and sweeping change in favor of small steps

Don't let human emotions adversely affect your finances, particularly during times of stress.

Being smarter about money doesn't have to be all-or-nothing. Try these small adjustments

Before you declare you're going to stick to a strict budget, save 20% of your salary and never again buy anything off the internet, take a beat and be realistic. Make plans for adjustment rather than austerity.

Potential Trump tariffs, like many things in life, are not all good or bad

Isn't it obvious we should hate tariffs? Not necessarily.

Think of your financial choices as a path to discovery

Every financial decision you make sets you on a path of discovery. There is not a GPS to effortlessly guide you. Instead, you bushwhack your way through what you thought life would be like to get to the way it really is.

Some financial planning steps to take now in this economy

While economists might lack prescience with their forecasts, they still provide valuable insight into our money moves.

Ask questions instead of jumping to solutions

Rather than focusing on making a financial decision, explore questions that can help you determine what is really worth your time and money.

Disordered thinking can lead you to making foolish financial decisions

Focusing on a dollar amount is disordered. What is important to understand is what that dollar amount represents to you.

Religious ideas can help guide your secular financial planning

Saving is an act of faith, investing for an uncertain tomorrow with a belief it will create a better future.

'Decoupling' isn't just about relationships; it can be used in your finances, too

Money can be complicated, but decoupling your financial decisions can make it less so.

Don't let 'what was' keep you from 'what is' when it comes to financial decisions

Whether you're selling your house or crafting your will, make sure you are being realistic about your life circumstances in managing your money.

Think like an investor, not a speculator, to make money

When you want to start spending money from your accounts should determine the way you choose to invest them.

What poetry can teach you about your finances

T.S. Eliot's poem "East Coker" has solid advice for managing money.

Consider the process, not just results, when making financial decisions

A good outcome with a bad process is simply luck.

Couples should plan, and dream, about money together

If one person makes the decisions, they could be short-sighted and also devastating to the other.

Advice to graduates: Seek work-life harmony, not balance

If you want to have a career rather than a job, forget about work-life balance and embrace work-life harmony, which is recognizing at different times in your life, you will have to work harder at the expense of other values and vice versa.

Eliminating emotional behaviors leads to sounder financial decisions

The work of recently passed Nobel laureate Daniel Kahneman helps illuminate how emotions can interfere with rational decisionmaking.

Assuage your money stress through family communication

What you can do that has proven useful in harnessing the money beast.

Don't let fear of financial regret deter you from a fulfilling life

Financial planners help their clients see what is possible while balancing living today and preparing for tomorrow. But not knowing how many tomorrows you have can create too much emphasis on an uncertain future.

What the Minnesota Twins can teach you about managing money

As a middle-market MLB team, the Twins have a lot in common with the average person trying to spend and save optimally.

Over-preparing for the recession that wasn't

It appears that a full-blown recession has been avoided, but the cost of this for investors has been potentially being too conservative too soon.

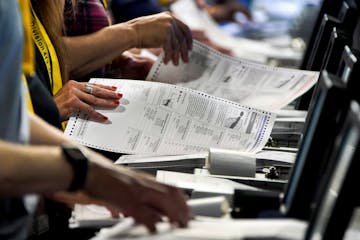

Should an election year change your stock market strategy?

Elections matter for policy reasons, which can impact corporate profits, which can impact companies' values, which can impact one's moves on the stock market.

Do not overlook the value of stopping

Take your time and rethink your habits when it comes to financial planning.

What pickleball can teach you about financial planning

Keep these three lessons in mind.

Identifying a touchstone word for the year may help you focus on your finances

Let's explore the many facets of a particular word in our financial lives: want.

You can stay in your home as you age, but should you?

Financial planner Ross Levin walks through why it might be a good idea to move out sooner than later.

The must-dos for retirement, including a medical directive

In financial planning, there are only a few things that you absolutely have to do. Including establishing powers of attorney, making a will and naming your beneficiaries.

The true benefits of diversifying your portfolio to allot for risk

You may give up some short-term performance, but it is much safer than pedaling against the traffic.

Ross Levin: After a sour year in stocks, focus on understanding your fear and greed

Did the falling markets affect more than they needed to?

Ross Levin: Giving feeds our soul, so why do we worry about it so much?

When you give, you are telling yourself that you have enough.

Levin: How parents can get twisted around on entitlement

Parents need to ask: Am I modeling entitlement or gratitude?

Ross Levin: Taxes are fair and unfair, debt is good and no good

Life is complex and it'll be nice to put aside the political caricatures for awhile.

Levin: Silence the investment critic in your head

Turn that critical voice into something more productive.

Levin: This is the exact moment to put cash to work

It's surprisingly easy to get a better return with your cash than a savings account provides.

Levin: Don't become 'anchored' in your financial expectations

There's a risk to become tied to an idea or price that doesn't really matter.

Levin: Incentives are powerful, but they can also pose hazards

Incentives usually drive big monetary decisions, but they can be misleading too.

Levin: Some people go to the State Fair and see their financial life in front of them

What you can learn from a stroll around the fairgrounds with ideas of money in your head.

Levin: When talking about money, many people could use a do-over

Sometimes people blurt out uncomfortable feelings about a financial situation. Here's to second chances.

Levin: What your financial planner should be asking you

The key question to be answered is: Does the planner understand you and your family?

Ross Levin: Four things you can do with your stocks in this bear market

Use losses for tax savings, rebalance what's moved off your plan and other ideas for a market that's a lemon.

Levin: Even with prices and rates rising, the equation for buying a home stays the same

Mapping out your time horizon and asset direction will help you decide whether it's better to rent or buy.

Levin: What a Buddhist concept can teach you about your finances

The notion of 'near enemies' can illuminate financial attributes or traits that seem appealing at first but turn out to be problems.

Levin: Action feels right at a moment of economic uncertainty, but it may not be

You can't have a victory if you are playing the wrong game.

Levin: What Tickle Me Elmo can teach you about economic bubbles

The concept of bubbles is an important one for investors, especially those who are trying to make big decisions about real estate and cryptocurrency.

Levin: Moving south part of the year to avoid Minnesota's tax — and other money mistakes

One of the hardest things to do in investing, and life, is to keep the big picture in mind.

Levin: Crypto, losses, capital gains? How to think about taxes in investment decisions

Avoid the investment mistake pro football player Trevor Lawrence made that cost him millions in taxes.

Levin: Playing 'Would you rather?' with your money will teach you a lot

The kids' game about competing choices holds surprising lessons for adults and their money.

Levin: In retirement, there are two investment risks and both are happening now

Inflation and volatility are the challenges to retirees' assets at the moment they are most needed.

Levin: Why emotions often overtake personal financial analysis

When money decisions turn emotional, people tend to put weight on the wrong things.

Levin: The market has turned, so do what you always should

Take the appropriate amount of risk based on your situation, not the unknowns of the market.

Levin: The last challenge in planning your finances is one of the hardest

For people of a certain age, there's no time like the present to plan for the end.

Levin: Let's play 'Ignore it or deal with it' with your money

Here are some simple ways to know what matters and what doesn't with your finances.

'The Great Substitution' applies to your investments, too

You can find substitution occurring everywhere — and this affects your life and your finances.

Levin: Watch out for the tricks of wealth

Investment advisers and clients sometimes engage in financial sleights of hand.

Levin: We all want certainty in our personal finances, but there is science involved

The precision of math can deceive investors, when there are too many influences on the outcome of investments.

Levin: When that infrastructure bill passes, the tax consequences will follow

For some businesses, it's best to defer some tax payments until the dust settles.

Levin: What to do when you want to change your life but can't quite see the picture

A recent book about the pandemic holds lessons for approaching your finances and planning.

Levin: People underestimate the costs of owning a home vs. renting one

The comparisons often exclude opportunity costs and the time spent on upkeep.

Levin: Don't expect a savior like Lassie to rescue your retirement finances

Only you can save yourself from an investor's worst tendencies: fear and greed.

Levin: Excited by rising house values? Some of your other assets may be more important

Not all assets and liabilities are equal. Here's a way to evaluate them beyond their numeric value.

Levin: Ask questions in a different way to zero in on financial motivations (and others)

To understand yourself, sometimes you might need to make an Opposite Day.

Crowded closets? Time to take a hard look at how they got that way

The lesson: Spend your life wisely.

Why it can make financial sense to allow yourself to feel sad

With a lot of tough stuff going on, if we don't experience our feelings, if we simply push ahead and stay positive, the consequences can follow.